|

|

|

Business News | August 2007 Business News | August 2007

Mexican Markets Hit by Credit Crunch Worries

Reuters Reuters

go to original

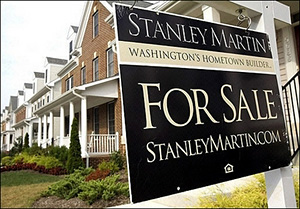

| | A leading US mortgage lender that specializes in high-quality, adjustable-rate jumbo loans to homebuyers on Tuesday postponed a dividend payment because of the turmoil in financial markets. (AFP/Paul J. Richards) |

Mexico City - Mexican stocks, bonds and the peso all fell sharply on Wednesday as investors worried that problems that began in the market for risky U.S. mortgages were leading to a global credit squeeze.

The benchmark IPC share index tumbled 1.64 percent to 28,422 points in choppy trading.

The peso gave up 0.54 percent as of its official central bank close of 11.1325 per dollar, a five-month low.

Rising defaults on U.S. mortgages, and the potential impact on U.S. consumer spending and U.S. economic growth, has led investors to dump all sorts of risky assets, from U.S. corporate bonds to Latin American equities.

"Mexico is like a corporate bond - not a junk bond, but at least something that you want an extra premium for in the current environment," said Felix Boni, head of research at Scotia Capital in Mexico City.

Mexico is particularly vulnerable to downturns in the U.S. economy because it sends nearly 90 percent of its exports to its northern neighbor.

The price on the benchmark 10-year government peso bond slipped 0.244 of a point to bid 100.41. The bond's yield, which moves inversely to its price, rose 4 basis points to 7.93 percent, its highest level since March 1.

"We still believe that there is more risk to be taken off the table," Toronto-based RBC said in a note to emerging market investors.

In Mexico's stock trading, Cement maker Cemex, a top supplier of the U.S. construction industry, dragged hardest on the IPC index as it tumbled 5.43 percent to 33.44 pesos. Its New York traded shares were off 5.57 percent at $30.

Dominant cell phone operator America Movil fell 1.91 percent to 30.22 pesos, while its New York-traded stock was off 2.54 percent at $54.20.

Top builder ICA slipped 6.43 percent to 62 pesos after announcing on Tuesday that it plans to offer new shares worth $550 million locally and in the United States. Its New York traded shares were down 6.62 percent at $66.77.

On the winning end, silver miner Penoles rose 2.02 percent to 136.40 peso. |

| |

|