|  |  |  Business News | April 2009 Business News | April 2009

Swine Flu May Be 'Devastating' to Mexico

Eric Martin - Bloomberg News Eric Martin - Bloomberg News

go to original

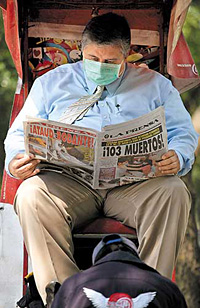

| | (AP/Enric Marti) |  |

The swine flu outbreak may be "devastating" to the Mexican economy and stock market by cutting travel and trade with the United States and slowing money transfers from abroad, said George Hoguet, global investment strategist at State Street Global Advisors Inc.

Swine flu cases in the United States doubled to 40 and Mexico's toll of flu-related deaths reached as many as 149 as concern about the disease spurred an emergency meeting of the World Health Organization. U.S. officials are urging that nonessential travel to Mexico be avoided.

"Should we have a reduction in the cross-border movement of people and trade, that would have a significant impact on Mexico," Hoguet said in an interview at the Milken Institute Global Conference in Beverly Hills, California.

State Street oversees $1.4 trillion.

"We're still very much in the early stages of determining the magnitude of the problem. It does have the potential to be a devastating event," he said.

The Bolsa Index dropped as much as 5.1 percent by midday Monday, the most intraday decline in three months, after Bank of America Corp. downgraded the country's second-biggest airport operator and said the swine flu could trigger a sell-off in equities.

International transfers are the No. 2 source of dollar flows into Mexico after oil exports, and Mexico sells about 80 percent of its exports to the United States.

Hoguet said State Street is "underweight" Mexican stocks.

FLU PANDEMIC

The WHO raised its pandemic alert to an unprecedented level on Monday, saying that swine flu is spreading across North America, two people familiar with the agency said. An increase to Level 4 on the WHO's six-step alert system was the first since the United Nations agency began grading the pandemic risks in 1999.

A flu pandemic capable of killing more than 70 million people worldwide would push the world economy into a "major global recession" costing more than $3 trillion, the World Bank said in October in a revised estimate of a worst-case scenario.

"It's a further shock to the world economy," Hoguet said.

Hoguet said April 18 that the rally in global stocks is likely to falter as a prolonged recession dents corporate earnings.

The MSCI World Index has climbed 27 percent and the Mexican Bolsa 29 percent since March 9 after lenders from JPMorgan Chase & Co. to Bank of America said they made money at the start of 2009 and the U.S. government unveiled plans to buy as much as $1 trillion in toxic assets from financial firms. |

|

|  |