|

|

|

Editorials | Environmental | February 2005 Editorials | Environmental | February 2005

Mixed Feelings as Treaty on Greenhouse Gases Takes Effect

Mark Landler - NYTimes Mark Landler - NYTimes

It is bad enough that American and Chinese companies will not bear the extra costs of the Kyoto Accords, but worse, the ultimate goal of curbing greenhouse gases will not be realized.

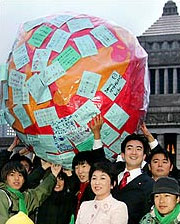

Japanese supporters of the Kyoto Accords presented a gift to lawmakers today at the parliament building in Tokyo. |

Ludwigshafen, Germany - From the day that Jürgen F. Strube joined BASF in 1969, his company has been cleaning up its act. At that time, it was making plans for a wastewater treatment plant at its chemical production complex here, which stretches for nearly five miles along the Rhine.

The plant helped purify the river, which sparkles these days as it flows past a tidy forest of pipes and smokestacks. Downstream from the factory is a vineyard that produces a crisp Riesling wine - which BASF, the world's largest chemical maker, buys in bulk to stock its million-bottle wine cellars.

That is why Mr. Strube, chairman of BASF's supervisory board, responds with a hint of impatience when asked how European industry plans to comply with the Kyoto Protocol, requiring Germany and 34 other nations to cut their emissions of carbon dioxide and other greenhouse gases.

As the agreement takes effect on Feb. 16, worries about its fairness are mixed with mild resentment. Europeans have set some of the most stringent targets for reducing greenhouse gases, which trap heat in the earth's atmosphere and have been linked by climate experts to global warming.

It is bad enough, in their view, that American and Chinese companies will not bear these extra costs. But worse, the ultimate goal of curbing greenhouse gases will not be realized because carbon dioxide emissions, unlike polluted rivers, are a global rather than a local problem.

"We have already done so much in the past that we feel others should not get a free ride," Mr. Strube said. "We could reach a situation where the leader is a lonely rider going into the sunset, and everyone else sits back and says, O.K., let's wait and see when he will return."

The pressure, he says, should be on the United States, which generates a fifth of the world's greenhouse gases but is staying out of the Kyoto system, or on nations with rapidly growing economies like China and India, which approved the agreement but are not required to reduce emissions - even though together, they already account for 14 percent of the world's total.

"The basic message has to be that we need to bring the other countries aboard," said Mr. Strube, who also heads a leading business group, the Union of Industrial and Employers' Confederations of Europe.

Still, in some ways, European fears may be overblown. Even in the United States, which formally rejected the pact in 2001, a growing number of companies regard mandatory reductions as inevitable. It is a future they must prepare for, whatever the politics of the moment.

There is a sense on both sides of the Atlantic that the Kyoto Protocol is already changing corporate behavior in lasting ways. From costly investments in carbon-filtering technologies to a complicated new system for buying and selling carbon-emission credits, the agreement is forcing change on businesses, regardless of whether they operate in Kyoto countries.

"The globe doesn't know whether greenhouse gas is coming from Bangor, Me., or Beijing, China," said Michael G. Morris, chief executive of American Electric Power, the largest electricity generator in the United States and a top emitter of carbon dioxide. "It simply affects the whole planet."

Mr. Morris said he thought that the United States would someday be party to a global treaty on greenhouse gases. At company headquarters in Columbus, Ohio, he said, they refer to it as "son or daughter of Kyoto."

To get ready for such agreements, American Electric has pledged to reduce the carbon dioxide emissions from its plants 10 percent by 2006 - a reduction that, while less radical than that levied on German industry, is in keeping with the spirit of Kyoto.

To be sure, not all American companies are looking as far ahead as American Electric, particularly smaller ones without overseas operations. And the political balance in the United States remains heavily tilted against mandatory reductions in emissions.

Senators John McCain, Republican of Arizona, and Joseph I. Lieberman, Democrat of Connecticut, have reintroduced a bill that would impose modest emission curbs. But the last time it came to a vote, in 2003, it lost 55 to 43. And the measure faces a harder struggle in this Congress.

American Electric is in the process of selling its power plants overseas, a decision Mr. Morris said it made for economic rather than environmental reasons. But he acknowledged that the unevenness of regulations could pose a competitive disadvantage for European companies.

For the same reason, he added, American concerns could be handicapped compared with Chinese or Indian competitors, because environmental regulations are stricter in the United States, even without acceptance of Kyoto requirements.

Still, there is little evidence that multinational companies are seeking to locate plants mainly in countries that do not adopt the protocol. Environmental regulations are one of several factors taken into account by businesses in making decisions on new sites, but they are less important than matters like labor costs.

"Companies like Dow and DuPont are keeping their overseas operations, and are learning to live with Kyoto," said Annie Petsonk, a lawyer for Environmental Defense, an advocacy group based in New York.

To live with the accord, the companies must master a bewildering new world. Negotiated in 1997 in Kyoto, Japan, it requires industrial nations - with varying targets - to reduce their emissions of greenhouse gases below 1990 levels, in the five years from 2008 to 2012.

For the European Union, the target is an 8 percent reduction below emissions levels in 1990. But the Germans went beyond that and agreed to a more ambitious target of 21 percent because they expected windfall gains by shutting down polluting, coal-fired power plants in the former East Germany. (It now seems likely to fall somewhat short of that.)

BASF led the German chemical industry in vigorously opposing the mandatory reductions. It argued that the rules put an undue burden on companies that must make decisions, like whether to build a new plant, on a longer timetable than the five-year life of the Kyoto pact.

Having lost that battle, the companies were required to take inventories of their emissions. They were allocated credits, typically for less than their current levels. These credits can be traded, which means that if a company is unable to meet the targets, it can buy credits.

Conversely, if a company achieves greater-than-required reductions, it can sell its unused credits at a profit. It can also pick up credits by helping finance the building of "clean" power plants in developing countries, or by taking part in reforestation projects, because trees absorb carbon dioxide.

The carbon market has developed rapidly in Europe, with credits for six million tons of carbon traded in January. (Each credit represents a metric ton.) The price of a credit fell 19 percent over the month, to about $9. Carbon, like other energy markets, is affected by the weather, with emissions rising when it is colder.

"The winter has been warm and wet," said James Emanuel, a carbon broker at Evolution Markets in London. "Plants aren't burning as much coal and because it's wet, hydro plants are producing lots of electricity."

Energy companies, which are used to trading electricity, have jumped into this market without hesitation. But for old-line manufacturers, the prospect of carbon trading can be daunting. "It's mostly a matter of mentality," said Markus Hüwener, a former investment banker at Dresdner Kleinwort Wasserstein who advises clients on how to deal with the market. "Germans like to have a law they have to comply with. The cap-and-trade system gives them too much freedom."

Indeed, the trading system is considered one of the Kyoto system's innovative features. Recognizing that greenhouse gases are fungible - emissions in China are no different from those in Europe, and they all mix freely in the atmosphere - it is an efficient way to reduce the overall level by allowing less-polluting companies to sell unused rights to emit.

For Mr. Strube, trading is a distraction from producing and selling chemicals. "If you are interested in exiting your business," he said, "then trading all your emissions rights might be an attractive opportunity."

BASF will not be able to avoid the trading game. Germany allocated it certificates for 1.2 million tons of carbon dioxide a year to operate its flagship factory complex here, which has two working power plants and one nearing completion.

That is about 85,000 tons less than its current emissions, which means that the company will have to make deeper cuts or buy additional credits, costing up to $700,000 a year.

This is not unmanageable for a company with $42 billion in sales. BASF also expects to lower its total emissions in Ludwigshafen, after it starts up a $300 million combined heat and power plant this year. That will enable it to sell credits, defraying at least part of its investment.

By far BASF's biggest investment is in China, where it is building a $2.9 billion petrochemical plant in Nanjing. Because it is using the latest technology, it says it will have little trouble complying with any emissions curbs that China may impose.

What concerns BASF is the next round of regulations at home. So far, European authorities have limited mandatory cuts to emissions-intensive industries like power generating and cement making. But it could expand that to include chemicals, affecting more BASF operations.

Mr. Strube and others are urging officials in Brussels to focus on luring new countries into participation rather than leaning harder on industry. The European Commission took some note of these concerns in its proposals for the post-Kyoto era, which it introduced early this month. It emphasized issues like halting deforestation, which appeals to the United States. But it also said emissions from planes and ships must be curbed, a proposal sure to be resisted because it could involve a fuel tax.

"There is still so much uncertainty about what the purpose of climate policy is," said Kevin Fay, a lobbyist in Washington who works on environmental issues. "It can't be, 'you emit, we cut.' Companies need to know what the long-term goal is, and long term is not just 2012."

As American companies try to make sense of a carbon-constrained future, some are seeking advice from the Environmental Protection Agency, which sponsors a voluntary program called Climate Leaders. General Motors, one of the 28 participants, said it had achieved its target of a 10 percent reduction in North American plant emissions from 2000 to 2005. It has not applied the goals to Europe, where it operates 11 plants in eight countries. It expects to face mandatory cuts there, but said it was not yet sure of the size. "It's still in a state of flux in Europe," said Kristin B. Zimmerman, G.M. manager of environment and energy policy.

For carmakers, of course, the issue is less how they run their plants than what they make. Two-thirds of carbon dioxide emissions come from cars and households - sources that are difficult to home in on because there are so many of them.

BASF is pushing Germany to give incentives to homeowners to insulate their houses. It has refurbished a 1930's apartment block near its factories to show that it can cut emissions 80 percent. The motive is clear: BASF makes the insulation.

"Some say it's best to put this off as long as possible," said Eileen Claussen, president of the Pew Center on Global Climate Change. "The other way of thinking is, 'We know we're going to be in this world, and our best bet is to develop technologies to benefit from it.' " |

| |

|