|

|

|

Editorials | Environmental | March 2006 Editorials | Environmental | March 2006

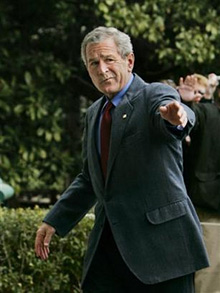

'Worse than a Fool'

James Wolcott - Wolcott.com/Vanity Fair James Wolcott - Wolcott.com/Vanity Fair

| | A ship's captain who loses his vessel to a freak 'perfect storm' may be blameless, but one who steers his passenger liner directly into a foggy ice field, having no sonar or radar, is worse than a fool: he is criminally negligent. |

Among the many peculiarities of this president is his utter refusal to listen to those within his own orbit in the oil realm. It's understandable, if unacceptable, that Bush would ignore the warnings of environmentalists regarding Peak Oil and global warming, but why would he tune out the words of his gummy ally Tony Blair, Matthew Simmons, the expert oil analyst and author of Twilight in the Desert who has briefed Bush personally, and Richard Rainwater?

"Richard Rainwater doesn't want to sound like a kook," began a profile of the super investor in Fortune magazine (the italics below are mine). "But he's about as worried as a happily married guy with more than $2 billion and a home in Pebble Beach can get. Americans are in the kind of trouble people shouldn't find themselves in," he says. He's just wary about being the one to sound the alarm.

Rainwater is something of a behind-the-scenes type - at least as far as alpha-male billionaires go. He counts President Bush as a personal friend but dislikes politics, and frankly, when he gets worked up, he says some pretty far-out things that could easily be taken out of context. Such as: An economic tsunami is about to hit the global economy as the world runs out of oil. Or a coalition of communist and Islamic states may decide to stop selling their precious crude to Americans any day now. Or food shortages may soon hit the US Or he read on a blog last night that there's this one gargantuan chunk of ice sitting on a precipice in Antarctica that, if it falls off, will raise sea levels worldwide by two feet - and it's getting closer to the edge.... And then he'll interrupt himself: 'Look, I'm not predicting anything,' he'll say. 'That's when you get a little kooky-sounding.'

Rainwater is no crackpot. But you don't get to be a multibillionaire investor - one who's more than doubled his net worth in a decade - through incremental gains on little stock trades. You have to push way past conventional thinking, test the boundaries of chaos, see events in a bigger context. You have to look at all the scenarios, from "A to friggin' Z," as he says, and not be afraid to focus on Z. Only when you've vacuumed up as much information as possible and you know the world is at a major inflection point do you put a hell of a lot of money behind your conviction.

Such insights have allowed Rainwater to turn moments of cataclysm into gigantic paydays before. In the mid-1990s he saw panic selling in Houston real estate and bought some 15 million square feet; now the properties are selling for three times his purchase price. In the late '90s, when oil seemed plentiful and its price had fallen to the low teens, he bet hundreds of millions - by investing in oil stocks and futures - that it would rise. A billion dollars later, that move is still paying off. "Most people invest and then sit around worrying what the next blowup will be," he says. "I do the opposite. I wait for the blowup, then invest."

The next blowup, however, looms so large that it scares and confuses him. For the past few months he's been holed up in hard-core research mode - reading books, academic studies, and, yes, blogs. Every morning he rises before dawn at one of his houses in Texas or South Carolina or California (he actually owns a piece of Pebble Beach Resorts) and spends four or five hours reading sites like LifeAftertheOilCrash.net or DieOff.org, obsessively following links and sifting through data. How worried is he? He has some $500 million of his $2.5 billion fortune in cash, more than ever before. "I'm long oil and I'm liquid," he says. "I've put myself in a position that if the end of the world came tomorrow I'd kind of be prepared." He's also ready to move fast if he spots an opening.

His instincts tell him that another enormous moneymaking opportunity is about to present itself, what he calls a "slow pitch down the middle." But, at 61, wealthier and happier than ever before, Rainwater finds himself reacting differently this time. He's focused more on staying rich than on getting richer. But there's something else too: a sort of billionaire-style civic duty he feels to get a conversation started. Why couldn't energy prices skyrocket, with grave repercussions, not just economic but political? As industry analysts debate whether the world's oil production is destined to decline, the prospect makes him itchy.

"This is a nonrecurring event," he says. The 100-year flood in Houston real estate was one, the ability to buy oil and gas really cheap was another, and now there's the opportunity to do something based on a shortage of natural resources. Can you make money? Well, yeah. One way is to just stay long domestic oil. But there may be something more important than making money. This is the first scenario I've seen where I question the survivability of mankind. I don't want the world to wake up one day and say, "How come some doofus billionaire in Texas made all this money by being aware of this, and why didn't someone tell us?"

The only explanation, apart from Bush's cognitive disability in facing reality, is that he sociopathically doesn't care about the coming calamity endangering the planet because he and his cronies will be financially prepared even as most Americans lose their standard of living.

There are so many reasons that Bush's name should be dragged through the dust of his post-presidency for the harm and disgrace his administration has inflicted, and so impeachable offenses for which he would prosecuted today if we had a Congress worthy of the Founders. His malign indifference to Peak Oil and global warming may be the greatest of his crimes, because it will lead to the misery and deaths of untold millions of people, animals, and natural resources.

Richard Heinberg, author of The Party's Over and Powerdown, methodically lays out the prosecution argument for the impeachment of George W. Bush.

While it would be difficult to create an airtight legal case for impeaching George W. Bush based on his ignoring the very real threat posed by Peak Oil, nevertheless I believe that his actions-and inaction-in this regard constitute dereliction of duty on an unprecedented scale.

It is part of the job of leaders to foresee problems and either steer around them or prepare for them. A head of state is analogous to the captain of a ship, who is responsible not only for keeping his vessel on course but also for avoiding hazards such as storms and icebergs. Some problems are not foreseeable; others are. A ship's captain who loses his vessel to a freak 'perfect storm' may be blameless, but one who steers his passenger liner directly into a foggy ice field, having no sonar or radar, is worse than a fool: he is criminally negligent.

The argument I will make, in brief, is this:

Peak Oil is foreseeable.

The consequences are also foreseeable and are likely to be ruinous.

The Bush administration has been repeatedly warned.

Actions could be taken to reduce the impact, but the longer those actions are delayed, the worse the impact will be.

The administration, rather than taking steps to mitigate these looming catastrophic impacts, has instead done things that can only worsen them.

Let us go through these points one by one.

Which he proceeds to do, convincingly, devastatingly.

James Wolcott is a Vanity Fair contributing editor. |

| |

|