What are the Risks and Tricks to Buying Property South of the Border?

Paige Phelps - peoplenewspapers.com Paige Phelps - peoplenewspapers.com

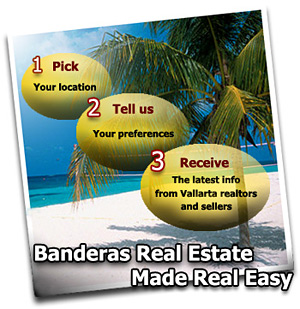

| Tired of searching for that 'Dream Property' in Puerto Vallarta? Just tell us what you're looking for, and we'll bring the Sellers to you!

Click HERE for more info. Click HERE for more info. |

|

If you could own pristine beachfront property just two and a half hours from Dallas, would you do it? What if that land was located in Mexico, does that make the land seem less appealing? If navigating foreign ownership and the hardships of a developing country come to mind when you think south of the border, you might want to think again. Mexico real estate is booming and now might be the right time to jump in to the market. Mitch Creekmore, senior vice president of business development for Stewart International, a Houston-based company that promotes and provides for private land ownership worldwide, explained Mexico’s land grab.

Mexico, he said, is the most prolific market in the northern hemisphere and was voted in 2005 by AARP as the fourth most popular destination for retirees in the world. Currently 1.5 million Americans own land in Mexico, he said.

American jewelry designer Darla Nordstrom has played the real estate game in Mexico longer than most Americans; she has called San Miguel de Allende her home for the past 30 years. “I own land all over Mexico,” she said. “I own on the beach, in the mountains, I own it in the desert. The value of the land has grown more than one hundred times in the last 10 years.”

She said navigating the difficult Mexican foreign ownership laws was easy when compared to the value the land would return to her. “I just realized that’s where I wanted to live and I knew that the land was going to be worth something someday, especially the pieces on the beach,” she said. Creekmore said many landowning Americans don’t quite get how easy it is now to own and keep property in Mexico. “‘Mitch,’ they say to me, ‘Aren’t there things like a restricted zone? It’s not vested? I don’t own the property? Isn’t there something like a 99- year lease and the government can take my property away?’” That was the case in the past, Creekmore said, but today’s laws are much friendlier to foreign ownership than they were three decades ago.

The Fideicomiso, a law established in 1971, entitled foreigners to acquire property in the constitutionally defined restricted zone — “all of that land within 100 kilometers of Mexican borders, or 62 miles of the borders; 50 kilometers inland, or 31 miles, along the Mexican coastline, and all of the Baja Peninsula.”

The result was land could only be bought by foreigners if they vested it in a Mexican corporation, with a Mexican citizen owning at least 51 percent of the company’s stock, or a federally chartered Mexican bank. Even then, the foreign purchaser only had a 30-year lease on the land. A step up from earlier regulations, but still a tricky investment for land owners.

In 1989, the laws were updated to allow foreign investors to renew their lease for another 30 years, but it wasn’t until the North American Free Trade Agreement (NAFTA) in 1994, that the laws of ownership changed drastically.

“The Mexican government made a critical change to revamp their foreign investment law,” Creekmore said. “Now foreigners can own 100 percent of stock of a Mexican corporation for whatever intended purpose.”

In other words, the law now says that if a foreigner is buying property that is not being used for residential purposes then “it’s a fee simple title, as long as it is in a Mexican corporation, but as a foreigner you can now own 100 percent of stock in that Mexican corporation,” Creekmore said.

For properties that are acquired for third party residential use, “whether that be a villa, a casita, a condo, a house, then the property must still be vested in a Fideicomiso, but now the trust is 50 years and there’s perpetuity — there can be no termination of the Fideicomiso of a Mexican bank trust,” he said.

Meaning, these days in Mexico, you can buy a lot inside the restricted zone right on the beach and you’ll have a 50-year renewable trust which continues to roll over. And, when you pass on, your children can be the beneficiaries of the ongoing trust, so the property never has to leave the family. “Mexico has become North America’s safe haven. Canadians and Americans are realizing they don’t have to go overseas to see something new and beautiful. Internal rates of return are good, appreciation is high, there’s an open arms culture in Mexico, the amenities are outstanding, there’s access to airlift, and the quality of the product varies, but it’s all very good,” Creekmore said. “Americans now understand foreign ownership and feel safeguarded by companies like Stewart … We bring a U.S. standard of title assurance and apply it to Mexican real estate.” The turning point in Nordstrom’s investments came with the creation of NAFTA.

“With NAFTA in agreement, everything had to come up. ... Prices started rising because Mexicans started globalizing,” she said. “You’re just not going to get a bargain like you would’ve years ago. That just doesn’t exist anymore.” And that jump in price was exactly the reason Creekmore and his team had come to Dallas in the first place.

High atop Uptown’s Crescent Club, Creekmore and his associates gave a presentation to interested buyers of Stewart International’s Punta Mita, a luxury gated community set on a peninsula on the Pacific coast. Lynne Bairstow, Punta Mita’s marketing director, said that homes and condos on Punta Mita will start close to $600,000 and go up to custom builds for $7 million.

“The real estate market in the U.S. is exceptional, but it’s starting to slow down,” Bairstow said. “Especially on the U.S. beachfront and California, prices are so high … At the same time, there’s a lot of opportunity to buy in Mexico now. People feel comfortable that the purchase laws are secure.”

Both Bairstow and Creekmore cited 9-11 as having a positive aftereffect on Mexican real estate, as well. “People are looking to be closer to home,” Bairstow said. Or, as Punta Mita Coldwell Banker Realtor Brock Squire put it, Punta Mita “is a two-and a half-hour flight from Puerto Vallarta to Dallas, the same flight time to California, Phoenix, Denver, or Salt Lake City.” “And it’s the same time zone.

How would you like to leave here at 8 a.m. and be on the golf course or having a margarita on the beach by 11 a.m. ?” Of course, some still have visions of precarious roads and warnings of dangerous bandits throughout Mexico, but even 30-year vet of Mexico Nordstrom said she’s impressed with recent improvements. “The roads in Mexico have really come up. With NAFTA they had to: The government made an agreement to have roads good enough for transportation,” Nordstrom said.

“I’ve seen miracles happen in the last five to seven years for roads, it’s incredible. It used to take me 18 hours to drive to the border, now it takes me eight. The Third World is now a First World with a few more problems.”

And if foreigners buy at a place like Punta Mita, they have the gated community aspect, as well as infrastructure like fiber-optic cable and white glove service that can even fetch items at the market for the homeowner, not to mention the Four Seasons on the same property.

“The price point in Mexico is very similar to the product here in the U.S.,” Squire said, saying that even so, U.S. properties with prices equal to those in Mexico will be much smaller and more crowded. “You need to look at property in Mexico as not only a second home but also as a very interesting investment opportunity.”

Email paige@peoplenewspapers.com |