|

|

|

Puerto Vallarta Real Estate | October 2006 Puerto Vallarta Real Estate | October 2006

Hot Mexico Market Just Gets Hotter

PRNewswire PRNewswire

| | Finance North America offers mortgages in Mexico with 10% down and no FICO requirement. |

There's been lots of real estate activity lately on the 1,951 mile US/Mexico border's southern side. Property sellers are celebrating increases in their holdings' values, home buyers snap up deals as fast as they appear, and realtors are holding onto their seats at what promises to be a five-year rising market in Mexico's real estate.

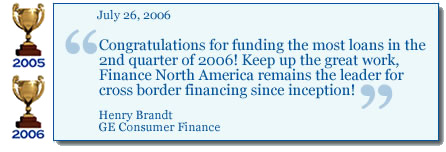

Driving much of the momentum is Finance North America (FinanceNorthAmerica.com) - a San Diego-based firm that in 2005 pioneered US-based financing for real estate in Mexico. Finance North America made it possible for real estate to be bought and owned there with traditional US-style mortgages by residents of other countries. Ownership opportunities were suddenly available to millions of Americans who were previously shut out of the market.

Interest was immediate - from Puerto Vallarta to Los Cabos, San Miguel Allende to San Felipe, Americans and Canadians began investing in retirement and vacation homes they'd long dreamed of owning. Custom-built, resale homes, and new condominiums, all lured northerners to own their piece of the beach in this growing market.

Not content to merely open up Mexico's vacation home, development and investment markets to all North Americans, FNA president Russ Schreier today announced three new successes from FNA's financial sources:

• Prepayment penalties eliminated. The company's extensive financial resources ensure fixed- and adjustable-rate mortgages with no prepayment penalties. This substantially changes past real estate purchases in Mexico, which used either cash-based or peso-based mortgages with tremendous economic consequences for early payment.

• No FICO requirements. FNA now arranges mortgage financing for borrowers with low FICO scores. As peso-based mortgages typically need a premium FICO score (700+), the ability to offer US-based mortgages without FICO requirements opens the market to the average consumer.

• Mortgages with just 10% down. Until now, mortgages arranged throughout Mexico required a minimum 25% down payment. FNA's flexibility opens ownership opportunities to large chunks of the market while improving borrower cash flow.

Thanks to Finance North America, the only decision to be made now is where along the 5,600 miles of sandy beach do you want to have your next home? Thanks to Finance North America, the only decision to be made now is where along the 5,600 miles of sandy beach do you want to have your next home?

For additional information, contact:

Finance North America

Russ Schreier

President & CEO

email: info@financenorthamerica.com

Toll Free from US/Canada 1-866-Yes-4-Mex (866-937-4639)

From Mexico 001-858-481-4871 |

| |

|