|

|

|

Puerto Vallarta Real Estate | January 2007 Puerto Vallarta Real Estate | January 2007

Mexico Mortgages Spur Boom

Ronald Buchanan - Latin Business Chronicle Ronald Buchanan - Latin Business Chronicle

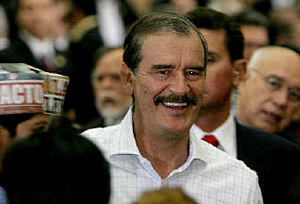

| | Former president Vicente Fox turned the drought in mortgage-lending that followed the nation's 1994-95 economic collapse into a near flood. |

It may lack the frenetic activity of Panama or the bargain-basement prices of Argentina, but the Mexican real-estate market is growing as never before on the basis of the nation's new-found economic stability.

The growth is evident in all areas: commercial, industrial, vacation and retirement properties, and upscale housing, but nowhere more than in low-cost homes. Hillsides on the roads leading out of the working-class north and east of Mexico's huge capital are peppered with housing developments. Though reminiscent of Pete Seeger's "little boxes", there ends all resemblance with those of the song. Seeger's little boxes were inhabited by people who played golf and drank Martinis; those who live in the new postage-stamped sized Mexican houses are former residents of hardscrabble barrios who often face two-hour journeys on public transport to reach jobs in the city center where some earn as little as $4,000 a year.

They are beneficiaries of a silent revolution in Mexico's capital markets — "like electricity, you can't see it, but the lights sure go on," as one banker said — that led to the construction of more than 3 million low-income homes during the six-year presidency of Vicente Fox that ended last December. Fox failed in achieving all the headline-grabbing reforms, in energy, labor and taxes, for which international investors were clamoring, but he turned the drought in mortgage-lending that followed the nation's 1994-95 economic collapse into a near flood.

A key has been the securitization of mortgages, a development launched by specialist lender Su Casita; high growth rates have attracted international banks to structure the bonds, and last year Su Casita's portfolio grew to almost $700 million. Infonavit, the government housing agency, has joined in, but there is still plenty of room for growth: mortgage-backed securities still account for only about 0.2 percent of GDP, compared with some 10 percent in developed economies.

The growth achieved by Fox has inspired his successor, Felipe Calderón, to aim for the construction of 1 million homes a year during his six-year presidency — a goal that market analysts say is well within reach and will mark a huge step forward for a country where the housing deficit is reckoned at 400,000 homes a year.

Mexico's foreign-owned banks are pitching in. BBVA Bancomer, the local unit of the Spanish-owned bank, aims to make $6.4 billion in mortgages and house construction loans this year, up from just under $5 billion in 2006. "We want to finance the construction of 110,000 homes this year," Eduardo Osuna, the bank's mortgage banking director, said last week.

Part of that $6.4 billion will be lent by banks acquired by BBVA Bancomer in Texas and California in recent years. The recipients will be Mexicans who live and work in the US, as well as the growing generation of US "baby boomers" seeking second or retirement homes — a sector that is attracting lenders on both sides of the border.

Donald Trump's $200 million Trump Ocean Resort Baja Mexico has highlighted a slew of US-financed developments in areas such as Baja California and Puerto Peñasco, Sonora (better known to Arizonans as "Rocky Point").

But Spanish developers are active too, particularly on the Riviera Maya, around Cancun. Indeed, buoyed by the strength of the euro, Spain outstripped the United States in investment in resort areas last year, according to the government tourism agency, Fonatur. And some of it landed up in places off the beaten tourist trail, such as the southeastern state of Campeche. The Campeche Playa Golf, Marina and Spa Resort will feature a Greg Norman-designed golf course and apartments beginning at $230,000. Spanish developer Grupo Mall is in talks with European banks with the aim of securing euro-denominated as well as dollar mortgages for the project.

Meanwhile, activity in commercial and industrial real estate is picking up fast as investors cash in on depressed prices that followed a glut caused by a building boom. By some accounts, "triple A" office space in the Santa Fe suburb to the west of Mexico City — beset by transport problems — is being let for as little as $15 per square meter a month, though rates in more central locations range from $21 to $27.

But, while optimism remains high following Mexico's longest period of financial stability of modern times, the horizon is not without a few storm clouds, not least the price of oil, on which the nation's government relies for more than a third of its income. |

| |

|