US Housing Prices Fall 14.4 Percent in Sign of Continuing Slump

Vikas Bajaj - The New York Times Vikas Bajaj - The New York Times

go to original

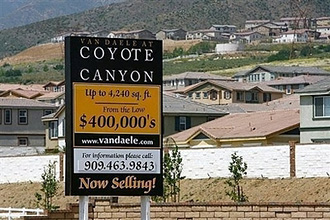

| | A billboard is used to entice customers to newly constructed homes in Fontana, California. The troubled US housing sector saw little relief in April as sales declined and prices fell further, creating a record glut of homes for sale, an industry group said Friday. (AFP/David Mcnew) | | |

America's home-buying season, when for-sale signs sprout like dandelions, is shaping up to be even worse than expected this year, with prices falling, sales slowing and few signs of a turnaround emerging.

Two reports released Tuesday captured the bleak picture. One showed that home prices nationally fell 14.4 percent in March from a year earlier. The other showed sales of new homes, although up slightly in April, remained mired near their lowest levels since 1991.

While Wall Street is growing hopeful that the economy might dodge a recession, many economists warn that the pain in the housing market may last for several years. Even local markets like Seattle, which once seemed immune to the slump, are weakening. Prices nationwide might fall as much as another 10 percent before a turnaround takes hold, economists said.

The problem boils down to supply and demand. As the home-buying season - that annual rite of spring and early summer - enters what is traditionally its busiest period, there are simply too many homes in many parts of the country, and too few people with the means to buy them. The situation is likely to get worse because a rising tide of foreclosures is flooding the market with even more homes, while a slack economy and tight mortgage market are reducing the pool of potential buyers.

Today's troubles can be traced to the excesses of the housing boom, said Ronald J. Peltier, the chief executive of Home Services of America, which owns real estate brokerage firms across the country.

"It's like eating beyond your stomach's capacity," Mr. Peltier said in a recent interview. "We have huge indigestion."

Sellers confront a sober reality: There are more than 4.5 million homes on the market nationwide. The way houses are selling, it would take nearly 11 months to clear the market. The last time so many homes were for sale was in the early 1980s, when the economy was in a deep recession and interest rates were two to four times as high as they are today.

For the most part, sales keep falling. Sales of existing single family homes tumbled 20 percent in the first four months of the year from the comparable period a year ago and are running at their lowest levels since 1998. Sales of new homes have fallen 42 percent over the last year. The Commerce Department reported Tuesday that sales increased 3.3 percent in April from March, when sales tumbled 11 percent, although the increase largely reflected a statistical revision to the earlier figures.

In Seattle, where housing had held up better than much of the rest of the country in the last two years, home sales have slowed sharply. Sales in King County, which includes Seattle, fell more than 33 percent in April from the same month a year earlier while the number of homes for sales is up 55 percent. Prices of single-family homes have fallen about 6.5 percent from their peak in July 2007 to February, according to the Standard & Poor's Case-Shiller index.

As in other regions, the slowdown is hitting outlying areas first and hardest. Sales and prices are still robust in downtown Seattle and affluent suburbs like Bellevue because they are more desirable and closer to big employers like Microsoft, Starbucks and Boeing.

"We are still getting multiple offers on properties there," Phil Rodocker, a Seattle-based real estate agent, said about the downtown area and Bellevue. But "as you move south, every 10 miles south you go, you see more and more short sales and repossessed houses."

Builders are having trouble selling units in some newer condominium buildings. Mr. Rodocker got an e-mail message from one developer last week who a few months ago had quickly sold 251 units in a project under construction. Now, investors who had signed contracts to buy 40 of those units had reneged. The units in the Belltown section of Seattle are now being resold for as little as $225,950 for a one bedroom with one bathroom, prices that Mr. Rodocker said were so low as to be "ridiculous." Last fall, one-bedroom condos in the neighborhood were selling for between $260,000 and $290,000, he said.

Seeing the number of homes on the market rise and prices fall, buyers are becoming more picky and negotiating harder, he and other agents said. Basic economics would suggest that lower prices should increase demand, but if buyers expect that prices will be lower still they will wait.

One of Mr. Rodocker's clients, Dennis Humphrey, lives south of Seattle in Tukwila and has been looking to buy a home with three or four bedrooms and one or two bathrooms. Parents of 10-year-old twin boys, Mr. Humphrey and his wife live in a rental home and want a bigger place.

Mr. Humphrey, who works in the home improvement division of Sears, has made offers on two homes but the sellers have refused to negotiate with him. He is willing to spend up to $300,000 and has enough money to put 20 percent down, but Mr. Humphrey said he is afraid to buy right now because he is worried prices are going to fall further and could wipe out any money he puts into a home.

"I am not afraid of the monthly mortgage payment, and I am not afraid of taxes, but I am afraid of losing the value I am putting in," he said, adding that a friend recently bought a home near San Francisco that has fallen in value by $70,000.

"I believe the right deal will come along," he added. "And I am in no rush."

While Mr. Humphrey is waiting by choice, many other buyers have essentially been locked out.

Since early 2007, lenders have dramatically scaled back the easy-lending policies that powered the boom and pushed homeownership rates to nearly 70 percent in 2004, up from 68 percent at the start of the decade. Gone are the days when borrowers could get 100 percent financing to buy homes without having to provide proof of their income and assets.

"Part of the increase in homeownership rate was a result of people being able to become homeowners because of easy credit," said Michelle Meyer, an economist at Lehman Brothers. Now, "you are pricing out many people from homeownership."

Most lenders are now only making loans that conform to the standards set by Fannie Mae, Freddie Mac or the Federal Housing Administration, which all require either a substantial down payments or mortgage insurance. These government sponsored agencies are evaluating mortgage applicants more diligently and scrutinizing borrowers who have second homes or recently became self-employed, loan officers say.

"Once the credit pendulum starts swinging from too easy, it never stops at neutral - it goes to too tight," said Lou Barnes, a mortgage broker in Boulder, Colo., who said he is turning down about two applicants a week. During the boom, he rarely had to turn down borrowers.

Some analysts say the scrutiny is well deserved even if it slows borrowing and home sales because it will assure better loans are made and that future gains in homeownership are sustainable. Compared to standards over a long period of time, these people say, lending guidelines are not all that conservative; it is just that the nation became accustomed to credit at very easy terms.

"One could say there is less money available," said Marc McGree, a real estate consultant outside Washington. "But today's standards really aren't so different from eight years ago or so, before the market over-heated." |